On Monday, Professor Real Estate® Suzanne Hollander sat down with Bisnow and shared her insights on Miami’s dynamic Real Estate Market. Suzanne discussed impacts of recent large real estate purchases in Miami and foreign investment in property. Read the March 26, 2024 Bisnow article below and Learn Something Real Estate! Suzanne’s insights are highlighted below.

Some predict a coming correction, while others say the market is insulated from national trends. Bisnow decided to answer this question with a look at the data. Charting the performance of Miami’s condo, apartment and office markets from pre-pandemic through the end of 2023 helps to paint a clear picture of where the market stands today.

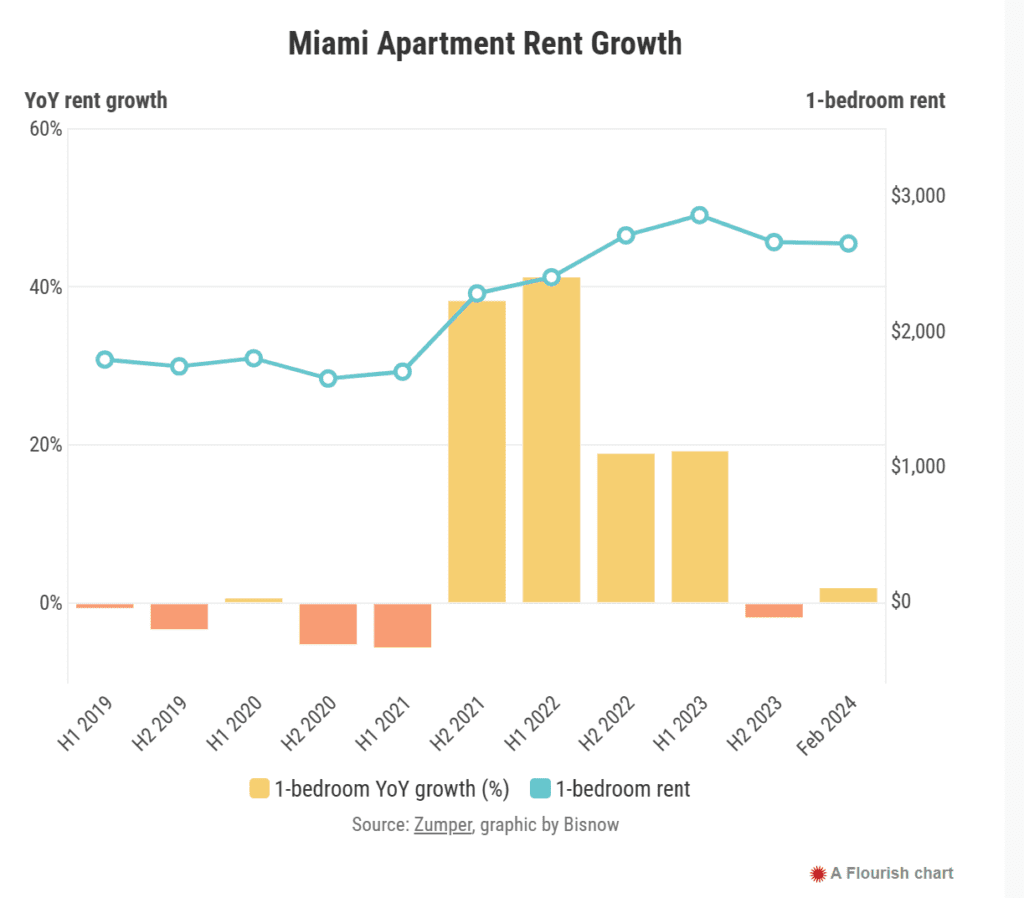

It’s clear the city has slipped from the highs of activity in 2022, when the pandemic supercharged relocation decisions for both individuals and employers, but the market remained resilient last year.

The city is in many ways returning to a pace of growth seen before Covid-19 lockdowns and the rise of remote work, but the market has held on to many of the gains that era produced.

First, the condo market, where the volume of sales in Miami-Dade County peaked from the beginning of 2021 through the first half of 2022, according to data from Redfin. Just under 33,000 condo sales closed in that 18-month span, helping to push the median price up from $250K at the end of 2020 to just under $400K by mid-2022.

Sales volume has since fallen back in line with pre-pandemic averages, leading to stagnation in price growth, with the median condo sold at the end of last year closing for $2,500 less than the market peak.

“A lot of people have locked in at the much lower long-term financing rate, so the number of transactions that are going on has gone down because of the higher lending rate,” said Ken Johnson, associate dean of graduate programs in the finance department at Florida Atlantic University, who specializes in real estate markets.

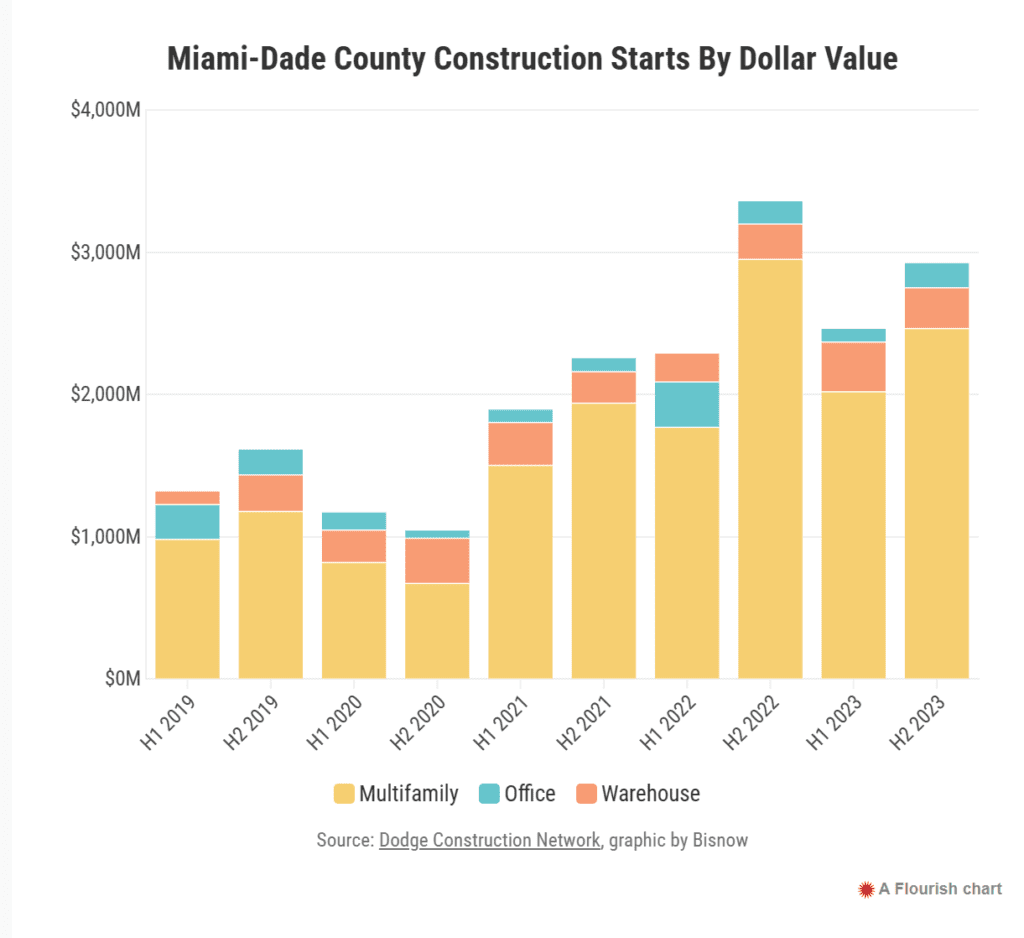

Developers have continued to pour money into condo construction, as there were more than $4B in multifamily starts last year, but there are signs that many current condo owners are looking to sell as the price of ownership has risen dramatically.

Florida had nearly 5,000 Zillow listings at the end of February from homeowners describing themselves as “motivated” sellers, more than double any other state, with a cluster of those listings in South Florida.

The average rate of homeowners insurance has doubled in the last three years, according to the Insurance Information Institute, which ranks the state as the most expensive place to insure property in the country.

Changes to state laws governing repairs at condos are leaving owners confronting massive increases to association fees or large one-time assessments, motivating many to sell as South Florida’s politicians grasp for solutions to keep people in their homes.

A stable flow of buyers from other markets, both from the U.S. and abroad, has kept Miami from seeing a dip in pricing. But some investors are wary of where the market is headed.

“It’s done very well because it’s Miami, but we’re not sure if the fundamentals are there,” said Brian Underdahl, chief analytics officer at Nuvo Capital Partners. His firm is looking to acquire $1B in distressed multifamily real estate by the middle of 2025, but Nuvo is avoiding South Florida even as it looks to primarily invest in other Sun Belt markets.

“There’s strong demand from foreign investment, and I think that will continue to keep prices high. But the reason it’s a question mark is because we’re not sure if it’s fundamentals or just demand from foreign investment that’s driving the prices,” he said.

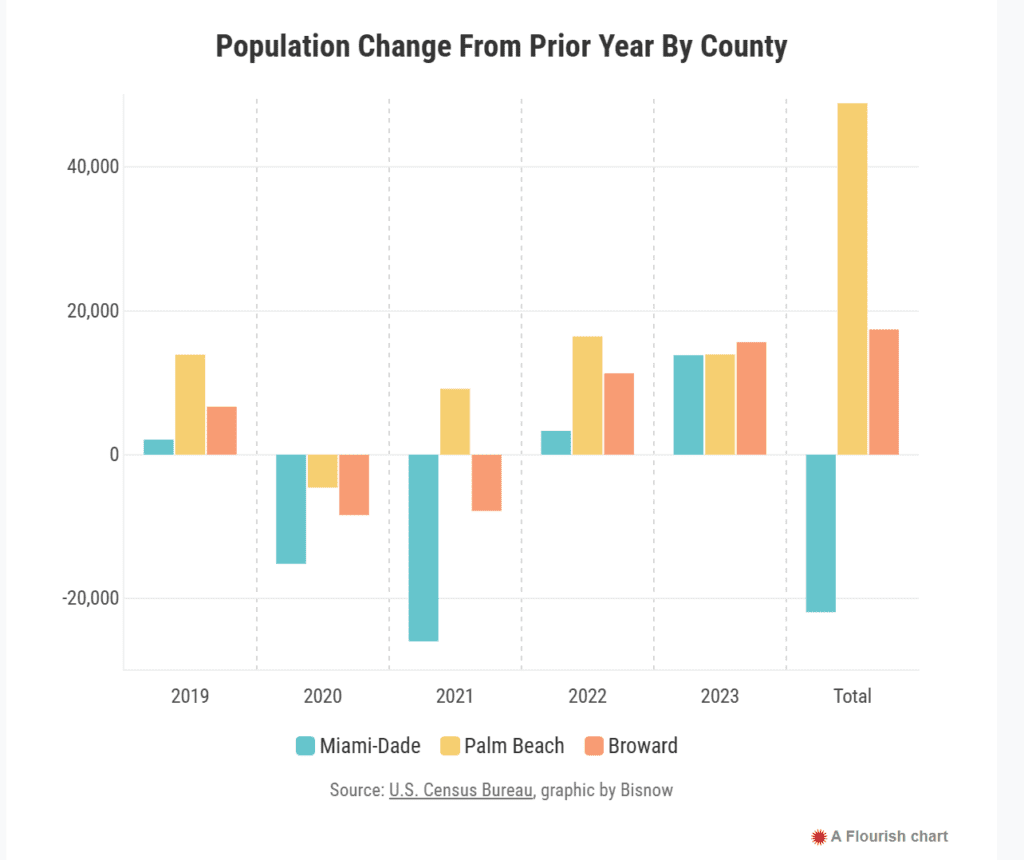

Florida’s population grew by 1,072,510 people between April 2020 and July 2023, second in the country behind Texas, according to Census Bureau data. For three years running, the Sunshine State has been just behind the Lone Star State in U-Haul’s calculation of top states for inbound migration.

But county-level data illuminates key differences in South Florida, with the Census Bureau calculating a 21,896-person decline in population from 2020 to 2023 in Miami-Dade County, while Broward and Palm Beach counties both saw population growth.

Much of the migration to South Florida was driven by the wealthy. Miami counted 38,000 millionaires in its population at the end of 2022, a 75% increase from a decade earlier, according to a report from Henley & Partners. Miami had 160 residents worth more than $100M and 12 billionaires at the end of 2022, and the city led the country in the number of second-home owners earning more than $100M.

Palm Beach County, by contrast, saw a 90% increase in the number of millionaires over the decade but only counted 9,400 millionaires in its population at the end of 2022.

The influx of wealth was driven by both the pandemic and the effects of the 2017 Tax Cuts and Jobs Act, which reduced the amount of property tax that homeowners in states with high property taxes could deduct.

“[State and local] taxes were taking a big chunk of profits that people were making in the states that have a lot of taxes like New York, New Jersey, Maryland and California,” said Suzanne Hollander, a real estate attorney who teaches real estate law at Florida International University.

The arrival of high-net-worth individuals has pushed prices up, which has in turn pushed many current residents to look for less costly places to call home. As of January, a South Florida household needed to earn $108,608 per year to avoid paying more than 30% of its income towards rent, $30K higher than the national average, according to Johnson’s Rental Index.

While Miami was losing residents at the start of the pandemic, the trend reversed in the last two years. As rent growth moderates, long-term Miami residents are finding ways to stay in the city. Johnson said he’d be “willing to wager a small automobile” that the average number of people living in each apartment unit has increased in recent years.

“That’s how we historically as a society dealt with this,” he said. “The Golden Girls, The Odd Couple, those weren’t just sitcoms back in the ‘60s, ‘80s and ‘90s. those were real-life situations depicted in a sitcom where people dealt with high housing costs.”

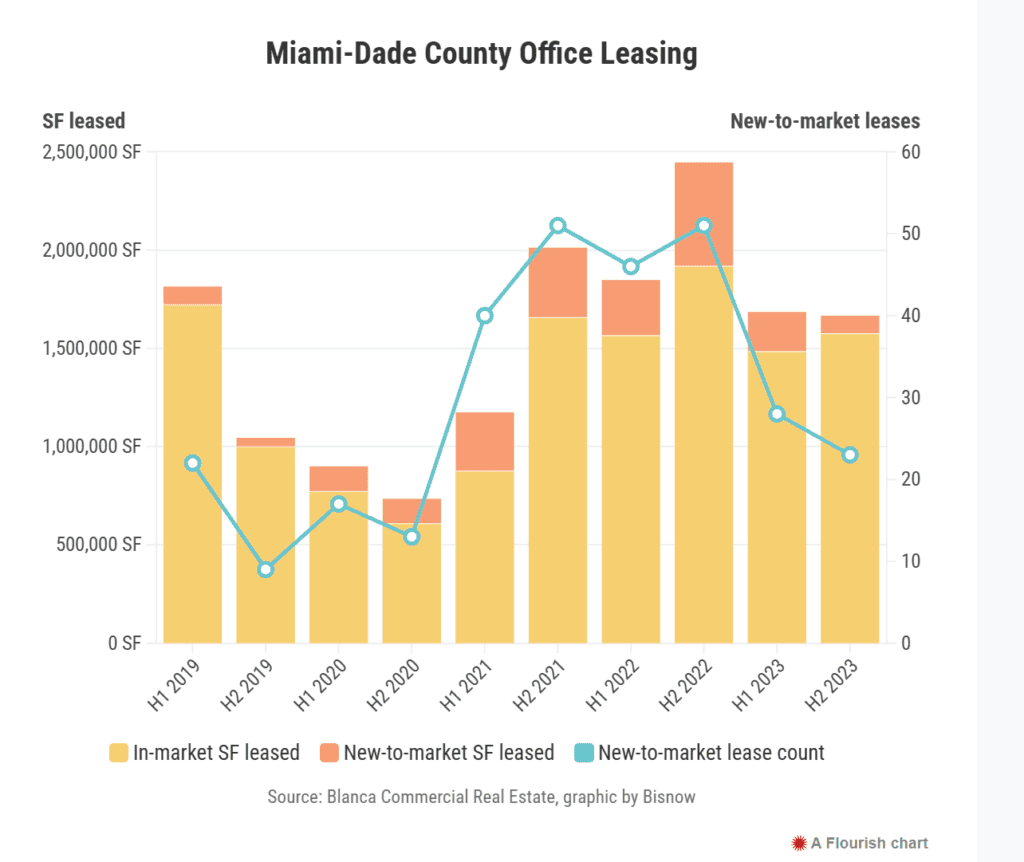

The arrival of well-heeled residents to Miami coincided with a surge in companies that previously had no office presence in the city to lease commercial space, helping propel the city’s office market above historical averages as more established financial and commerce hubs suffered.

Tenants from other cities signed 188 new leases in 2021 and 2022, according to Blanca Commercial Real Estate.

The June 2022 announcement that Citadel, the hedge fund led by Ken Griffin, would shift operations from Chicago to Brickell was among the highest-profile relocations, but Microsoft also leased 50K SF in the city in September 2021 and private equity firm Thoma Bravo signed a 36K SF headquarters lease five months earlier. National law firms followed their clients, with Baker McKenzie, Sidley Austin and Kirkland & Ellis all signing their first Miami leases.

The announcements from linchpin firms provided credibility for other players to set up shop in Miami and spurred a wave of leasing from the companies that service the market leaders.

“They call it the Citadel halo,” Hollander said. “If Ken Griffin feels comfortable here, then other funds and other serious financial institutions don’t have to justify why they’re choosing South Florida as a headquarters or as a place that they’re going to be doing business.”

But the halo has lost its shine over the past year, with the share of new-to-market leasing declining significantly. However, the 51 new-to-market tenant leases in 2023 still outperformed pre-pandemic years. The market is still drawing interest from new arrivals, but most are looking to set up small outposts as opposed to expansive operations, Tere Blanca, the CEO of Blanca Commercial Real Estate, previously told Bisnow.

Many of the pandemic-era arrivals are also adding to their footprint in the city as they expand operations, helping to boost overall leasing volume.

Matt Birnbaum, Blanca’s research director, said in an email that the brokerage was tracking 4.5M SF of active leasing demand in the market for 2024, with around 800K SF of those requirements coming from new-to-market tenants.

Miami had 1.6M SF of Class-A office space under construction at the end of the year, according to Blanca, but just over 1M SF of that is in 830 Brickell, a 55-story tower that is nearly fully leased ahead of its delivery later this year.

The limited supply of new space could be the factor that slows leasing in 2024, Birnbaum said, as firms execute on space upgrades to draw employees back to the office.

General uncertainty around the future of the workplace has kept investment in new office space depressed, even in Miami, despite a wave of proposals for new office towers. Multifamily investment, by contrast, has outpaced pre-pandemic levels since 2021, with construction starts totaling more than $11B in the last three years.

Luxury condo towers with brand integrations dominate Miami’s development pipeline, along with a wave of short-term rental condo projects being sold as investments. Developers are leveraging pre-sales and buyer deposits to win over lenders and reduce overall construction debt to get projects out of the ground despite the high interest rate environment.

Miami is attracting capital from domestic lenders as well as foreign investors looking to buy into assets that offer relative stability compared to the outlook in their home countries.

“They say that to work in Miami real estate, you should also be a political scientist and know what’s happening with all the presidents in Latin and South America,” Hollander said.

She’s spent time working with family offices and investors across Latin America and said those investors “want to invest in the U.S., and they’d like to invest in Miami because they feel comfortable here. But they’ll invest anywhere where there’s a good return.”

The investment demand has carried into this year, with condo projects in Miami attracting at least $932M in construction financing since February.

The largest loan was $600M provided to Mast Capital to build the branded Cipriani Residences in Brickell, which the firm said was the largest ever loan for a single tower in Florida.

Los Angeles-based Ascendant Capital Partners provided $250M for the project. The remaining $350M came from Mexico City-based Banco Inbursa, owned by Carlos Slim, Latin America’s richest person.

Shared from Bisnow March 26, 2024 Article Written by Matt Wasielewski at matthew.wasielewski@bisnow.com

Disclaimer: Professor Real Estate® written materials apply generally to real estate subjects and are not intended to apply to specific legal issues.

Copyright 2024 ~ All rights reserved. ~ Professor Real Estate® Suzanne Hollander

Comments are closed