Shopping Centers in Latin America Offer Customers “Happiness in this Life†and Democratic Values – Tips to Learn from Latam for Your Shopping Mall

Reprinted from Real Estate Issues Volume 47, Number 4 – February 10, 2023 with permission of Counselors of Real Estate® of the National Association of REALTORS®.

Written by: Professor Real Estate® Suzanne Hollander, Esq.

Shopping Malls1 in Latin America are full of people and fully leased to pre-pandemic levels. How can this be? The sociopolitical unrest in Latin America creates a roller coaster ride of highs and lows of inflation, currency fluctuation and political uncertainty, however, despite these challenges shopping centers in these countries are vibrant centers of commerce and community.

In the first 20 days of 2023, riots in Brazil and Peru were in international news headlines. During 2022, Chile suffered political unrest leading to a controversial attempt to alter its constitution and property rights. Argentina suffered a return of socialism and a populist government, political unrest and untamed inflation fueling an exodus of global retail brands (tenants). In Argentina I saw many retailers who instead of posting prices on goods for sale, posted signs that said, “Ask for Price†in order to address the impacts of inflation.

Is there something global shopping mall owners, especially mall owners in the United States of America (U.S.) may learn from Latin America about the fundamentals that build a lasting bond between the mall, retail tenants, consumers and the community through both good and bad times? Is it really an excuse to say the U.S. rise in inflation and or the increase in online sales are the only culprits for the decline of the U.S. shopping mall? Is there something more that mall owners can do to save it?

I know there is.

This article discusses the fundamentals, building blocks, of why Latin American shopping malls are at full tenant occupancy and full of people in spite of their challenges, and, what the mall means to the heart and daily life of people in Latin America.

I made these observations during my 2022 sabbatical in Brazil, Peru, Argentina, Chile and Paraguay. The combined size of this market is massive, nearly the size of the U.S., with a total population of 319.23 Million (Brazil – 214 Million; Argentina – 45.81 Million; Peru – 33 Million; Chile – 19.2 Million; Paraguay – 7.22 Million). Today in 2023, I continue my daily connection with the owners, retailers and brokers in these real estate markets.

Please keep in mind, each country is different and has its own challenges and risks and rewards. This article provides a general overview. Please feel free to contact me if you want to dive deeper into the situations in specific countries in Latin America.

During my sabbatical, my “Feet were on the Street,†as I visited approximately 70 shopping malls in five countries and conducted qualitative interviews with shopping mall owners, brokers for the “marksâ€(retail brands/tenants), managers, real estate attorneys, retail trade associations, investment groups, and real estate professors. Walking the mall with an owner, manager, or expert broker was imperative for me to fully understand the tenant mix, vacancy, high and low traffic time periods, how the shopping mall is used throughout the day, the demographics, physical layout and design of the mall. One must note how the physical space is used – where and what percentage of the mall is allocated to gastronomy, traditional retail, fast food, health, lifestyle, entertainment, education, transportation, and other uses, and, the location of the shopping mall relative to where people live, work and play.

- The Cow Only Gets Fat when the Owner is Watching

In the Latin American retail real estate sector, owners of shopping malls are normally family offices. The family owner is on site every day, including weekends. The owner knows their tenants by name. The owner speaks directly with the “marcas†(brands/tenants) to bring them to the shopping center and the owner often does not use an outside broker, it has an internal team. The owner knows the customers and greets them, the customers know the owner.

This is in contrast to the U.S., where malls are often owned by REITs or Pension Funds and operated by their employees. These employees sit in offices located far away from the mall (maybe even in another state) as they work on spread sheets that set corporate goals for the mall to hit a return rate. They don’t go to the shopping center every day. They don’t build the connection with the tenants. They don’t know the community.

The owners of Latin American Shopping Centers are “the Retailers of Retailers†meaning they understand their success is tied to the success of their tenants (the “marcas†the retail brands) and the owners are very involved in the business of the retail brands in their centers.

The owners are actively on site at the mall, even in Brazil where there has been consolidation of the malls. Here, corporate owners such as Brookfield, among others, share an investment interest in several malls with the family owners. For example, when I visited RioSul mall in Rio De Janeiro, I met with both the representative of the family office and the Brookfield representative who are joint owners of RioSul and they were both on site at the mall and involved in the daily operations.

- Is There Life without a Lender?

When I teach commercial leasing I discuss the codependent relationship between the parties to the Lease, the shopping center Owner, Tenant, and the “hidden†party to the Lease, the Lender. Although a Lender is not a party to the Lease in the U.S., the Lender has significant influence on the relationship between the Owner and the Tenant because of the Owner’s covenants to the Lender in its mortgage documents. Due to Owner legal obligations to the Lender and default provisions of the mortgage, during the COVID pandemic, many U.S. Owners could not modify tenant lease payments or terms without first obtaining Lender permission. In addition to being overwhelmed with requests during the COVID pandemic, corporate lenders are often bureaucratic, therefore these situations took time and strained the Owner/Tenant relationship. From the tenant point of view it seemed even as if the Owner was “out of touch†because it could not react to the situation in a timely manner.

In Latin America debt is not available to finance shopping malls for a variety of reasons, including unpredictable inflation (especially in Argentina and Venezuela) and currency fluctuations. The impact of this is that the owners finance shopping malls themselves.

Latin American owners take on more risk, therefore, they have their ear to the ground and are “in touch†with their tenants and customers to make deliberate decisions based on up-to-date information. As a result, Latin American shopping mall owners are nimbler and more flexible to make decisions because they do not need Lender permission. A corollary to this is that it is challenging to start in the retail industry because there is no debt available. Furthermore, in Latin America, the mall owner must pay for infrastructure and build, develop, and maintain the roads, water and sewer, traffic lights, and utilities that serve the mall and its customers. U.S. mall owners may take some of this public infrastructure for granted because their county or local municipality may already provide it (think paved roads, sewer, water) or provide some financial incentives.

In the U.S. we currently see many portfolios of shopping malls in some form of foreclosure, special servicing or bankruptcy. The lender and or special servicer is not always an expert at retail tenant operations. How can these malls survive and thrive?

For example, U.S. indoor malls are defaulting on their loans – Paris Based Unibal Rodamco-Westfield (UNIBAL) is selling its entire portfolio of 24 U.S. Malls – including some of the highest profile malls in U.S., including the Mall at the World Trade Center. Unibal purchased the portfolio from Westfield Corp in 2018 for $15.7 Billion and at the end of 2021 it was valued at $13.2 Billion.

- Target Customer: One Million Shoppers with One Dollar or One Shopper with One Million Dollars?

As mentioned previously, the total population of the five countries I visited is nearly 319.23 Million (nearly the size of the U.S. population). Approximately 70% of their population (223.46 Million) is low to middle class, and, part of what is known as the “informal economy.†Members of the informal economy do not have access to banks, traditional methods of payment such as credit cards or Wi-Fi access at home. In these countries, members of the informal economy far out number members of the formal economy.

Latin American shopping malls largely target this segment of the population, in a format that invites them to believe they are (or may soon join) a superior, aspirational class. Who can argue with this when all classes and socio-economic levels mix side by side in the shopping mall and do not mix in other places in these countries.

A real estate consultant working throughout Latin America and Spain shared with me the business strategy, “It is better to have one million customers with one dollar than one customer with one million dollars.†In Latin America it is too risky to focus on luxury brands because the luxury buyer may easily choose to fly to Paris and buy the Louis Vuitton purse in person and have an experience, versus shopping locally. There is not enough luxury demand to sustain the retailers and shopping centers. The one million customers with one dollar will shop at the mall again and again as they have no other alternative.

Knowing the target population, some retailers and mall owners help customers find a way to make their purchase by offering their own type of credit cards (such as Falabella and its chains) or ways to pay via prepaid cell phone apps. A large majority of the people who are in the “informal economy†do have cell phones but do not have traditional bank accounts or access to credit.

As a political tactic to satisfy this large population segment, during times their work is interrupted by events such as COVID or social-political uprisings, some governments’ regimes are allowing citizens to tap into their pensions early and/or they are directly paying people. Instead of depositing the money in the bank, people go to the mall to shop because they are fearful the currency may be devalued sitting in their pocket and/or because they don’t have access to a bank account.

Latin American mall owners are aware of this and know, despite economic hardships, people will buy because the inflation epidemic scares them into thinking that they need to spend the dollar in their pocket today because tomorrow it may be worth half, or less.

- Dense Urban Locations

Latin American shopping malls are located in the heart of the community surrounded by residences and density. People can and do walk to the mall every day or go via public transport, if available, with stops inside the Mall in some cases.

The culture of Latin America is to get together – people want to go meet – they want a punto de encuentro (a meeting point) to have a coffee, to be together – they don’t want to live far away in a house surrounded by a white picket fence, shopping remotely and having Amazon leave their purchases at the doorstep.

To be fair, online shopping in Latin America is not as effective or convenient as it is in the U.S. Packages do not arrive in a timely fashion, and it is not always as economical. Therefore, the shopping center provides a location where the lower and middle classes may aspire to be part of the more formal economy through purchasing goods and participating in unique experiences such as pop-up museums, art exhibits, zoos, and performances.

Conversely, in the U.S. during the 1940s, after World War II, people moved to the suburbs and away from downtown shopping areas that had been dominated by small family owned department stores. That gave way to regional malls and retail chains leading the way for developers to build sprawling open air shopping centers and big box stores.

A downtown Miami shopping center owner told me, “U.S. shopping malls used to sit out in the middle of a field and everyone had to park a car and to go shop – now people want malls in the center of a city with hotels and apartments surrounding it to create activity – there is a change in mentality, in the way people are looking at things.â€

“Nobody’s hanging around after work in many urban areas because so few are even going to work in the first place†said CNBC anchor Brian Williams three months ago. Security Access firm Kastle Systems tracked office use in ten major U.S Metropolitan areas for the week of October 3 – October 7, 2022 and reports that office use averaged 47.4% of early 2020 levels.

- The Heart (“Corazónâ€) of the Community – Customers Love the Mall

Unfortunately in the U.S., increasingly we see violence and shootings take place in shopping malls. I asked a leading operator of malls in Chile, Peru and Colombia, “Given the social unrest in your countries and demonstrations in the street and against government buildings and even metro stations in Chile, why don’t we see that violence in your malls?†She replied with a smile, “people love the mall, the mall is their backyard.â€

In these countries the majority of the population does not have a backyard and governments do not invest in social infrastructure like green spaces, libraries, parks and in some cases even roads and sidewalks. The mall owners do.

The people feel “proud†of the local mall because the mall provides them something they can’t find elsewhere – a safe, clean, beautiful place to meet equipped free Wi-Fi and to spend time with the family.

Another consultant explained it to me in simple terms, “the bathroom in the mall is, in most cases, much cleaner and more beautiful than the bathrooms in the homes of the customers.â€

Jockey Plaza, the largest mall in Peru, understands this and caters to the people, with a slogan “You are a Citizen Here and You Have Rights.†I’ve seen the mall’s banners with slogans saying, “You have the Right to Safety†“You have the Right to Cleanliness†“You have the Right to Peace.†The mall enforces these rights.

Just this week, I asked the Jockey Plaza mall Operator, “how are the sales given the current political demonstrations in Peru?†and he responded, “curiously, sales increased.†This could be because people feel safer inside the mall than outside in the streets.

In Mall Plaza Oeste, Santiago, Chile’s largest shopping mall, I visited an onsite small zoo, a green space and park with a pirate-ship that is free for all to enter. The mall makes sure to include several uses that make a day at the mall productive for the whole family including, a “boulevard†of financial services of several different banks, an area to purchase cars of all various brands beside a gastronomic food court and new movie theater offering both a normal and luxury movie experience.

- Everything You Need for Life is At the Latin American Mall – A “Marketplaceâ€

In the U.S. there is now a trend for “demalling,†in other words, reengineering the mall to have a variety of uses. The change is profound. In May 2021, ICSC, International Council of Shopping Centers (ICSC) the U.S. based global association for shopping malls with over 70,000 members changed its name to Innovating Commerce Serving Communities and now uses the term “Marketplace†instead of Shopping Center. On its website, ICSC explains, “The Marketplaces Industry is made up of the places and spaces where people buy, dine, work, play and gather and is fundamental and vital to communities and economies.â€

Latin America still uses the word “Shopping†to refer to their malls although they really have primarily always been the marketplace experiences that U.S. owners are now trying to replicate. For example, in Mendoza, Argentina, Palmares Open Mall has an onsite medical clinic with over 150 doctors that sees 30,000 patients a day, as well as a university. A doctor from the onsite clinic attended to me when I got a cold during my tour of the mall. In Peru, I visited a full scale traditional church inside the Plaza Norte mall – it also has a car dealership, bus station and area where customers can take selfies in front of the “7 wonders of the world†without having to travel. Jockey Plaza has “Jockey Salud†an entire building attached to the mall that is a medical clinic.

As stated above, Shopping Malls in Latin America also bring experiences to their customers that act as a magnet to attract traffic. In Sao Paulo, Eldorado Shopping hosted “Mundo Pixr Eldorado†an immersive experience between Pixar Animation and Disney Brazil. I witnessed the long cue to enter full of crowds of people from all over Brazil who wanted to visit “Disney†but could not make the over eight-hour flight to Orlando.

- Physical and Digital Sales Lie Together/Complement/Reinforce Each Other– They Are Not in Competition

As we toured Morumbi Shopping Mall in Brazil (that in addition to stores, restaurants etc. also has an ice skating rink) the operator told me he often hears from the U.S. that the “mall is dead†because of online sales. He says this is not his experience, that he sees physical and digital shopping experiences now “lie in bed together†explaining that they are not in competition – they need each other.

A multinational retail tenant with stores located throughout Latin American malls explained to me the blend of “Frigital†meaning that the customer can shop on line and pick up the purchase in the mall. A retail and mall operator with malls in Chile, Peru and Colombia explained that a customer can order online from any of its brands (Falabella (retail store), Sodimac (Home Goods) or Totus (supermarket) and pick up their purchase at any location via a designated locker or pick up area.

Online purchases are now part of the shopping experience but not to the extent as in the United States for several reasons, including logistics and infrastructure and the cost of fuel which increases the price of goods and the time frame for receiving online purchases and the imbedded cultural norm that people like to visit the shopping mall in their neighborhood.

- Search for Innovation Transforms from Looking to the U.S. to a Concerted International Search Effort

A Mall owner told me that “Brazil used to look to the U.S. for Shopping Mall Trends – now U.S. Shopping Malls are more focused on shopping and not so much on family and wellness. That’s why Brazil is looking for new ideas for China and Japan – where they are more focused on innovation and atomization.â€

Latin American malls owners are very aware of their tenant and use mix. They plan it carefully to include goods and services people need (malls in Brazil even have car rental agencies on site) as well as entertainment and gastronomy. They are on the look out to bring innovative uses to their shopping malls.

- The Shopping Center – A Meeting Place – Values Place – ESG

Shopping Mall Owners in Latin America also know that their clients want to be proud that that the mall reflects their values. There is an increasing focus on ESG – Environmental Social Governance.

For example, in Sao Paulo Brazil, I climbed up to the roof of Shopping Eldorado to visit its organic garden maintained by mall employees, using food court left overs as compost, its produce is shared among its nearly 400 mall employees. The roof top garden (with views of Sao Paulo skyscrapers) is innovative, sustainable, good for the environment, reduces the carbon emissions of the mall and the community is proud of it

- Latin American Malls Reinforce Democracy

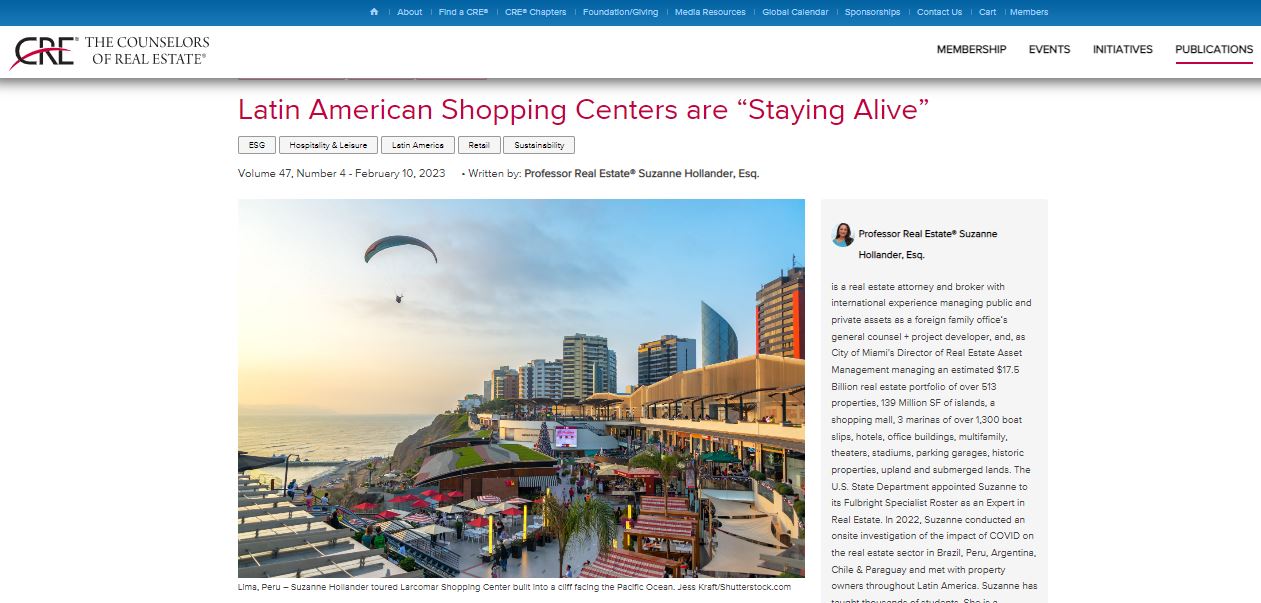

Latin American Mall Owners’ focus on the largest segment of the population is democracy in action. In addition to selling goods, the mall provides services such as manicured outdoor green spaces, cleanliness, air conditioning, heat, security, Wi-Fi access and entertainment to everyone. At Larcomar in Peru, the mall even provides a breathtaking Pacific ocean view. This is in stark contrast to other parts of these societies. As noted in Section 5 of this article, the largest mall in Peru, Jockey Plaza, takes this so seriously that it uses the slogan “You are a Citizen Here.â€

Conclusion:

People who live in Latin America and the people who live in the U.S. are different in the way they go about their lives although they are similar in terms of their love of Freedom and the satisfaction that comes with the power to decide what to spend their money on and how.

Shoppers in Latin America not only seek the best experiences, they are very spontaneous and, above all, value “sharing†them which is possibly the most important part of their pleasure in shopping. That vitality in the quest to share is where Latin American Malls shine and specialize. They know their customers perfectly because the owners of the Mall live with them daily, and do not allow the tenants to divert a millimeter from what customers love and expect.

Finally, it is very true that when Latin Americans travel to the U.S. they invade the malls with a voracious appetite for big brands that don’t have retail locations in their malls, but they never do it alone, always as a family, always as a way to feel united to the community, to share that pleasure together.

To conclude: Shoppers in the U.S. could be described as “Anglo Saxon†in their decisions, more rational and less intuitive, more formal and less spontaneous. Shoppers and shopping malls in Latin America show us that a large part of their lives is sharing, and, the mall reinforces democratic values, despite the day to day political situation of the country. Pope Francis tells them: “Happiness in this life.†And the shopping malls have interpreted it correctly.

Food for thought: the economy itself is not the factor that is hitting the shopping malls hard in the U.S. It is the new generations that are not attracted to the old model and want more than just consumption.

Read more about Suzanne Hollander’s sabbatical in this piece by the International Council of Shopping Centers.

ENDNOTES

Suzanne Hollander’s research was conducted in Spanish and Portuguese. See below translation references.

[1] In Spanish, shopping malls are often called “centros comerciales,†which directly translates to “commercial centers.†For the purpose of this article, ‘malls’ and ‘centers’ are interchangeable and both refer to the traditional United States concept of shopping malls.

[2] ‘Superintendiente’ is a title used in Latin American countries to describe CEO’s, directors, and administrators. For the purpose of this article, the direct translation of ‘superintendent’ is used to describe the shopping mall CEO.

Do you disagree with the author’s conclusion? Have a different opinion or point of view? Please share your thoughts with REI, or better yet prepare and submit a manuscript for publication by emailing the Real Estate Issues Executive Editor (or Board) on this article to rei@cre.org.

Written by: Professor Real Estate® Suzanne Hollander, Esq.

Reprinted from Real Estate Issues Volume 47, Number 4 – February 10, 2023 with permission of The Counselors of Real Estate® of the National Association of REALTORS®.

Disclaimer: Professor Real Estate® written materials apply generally to real estate subjects and are not intended to apply to specific legal issues.

Copyright 2023 ~ All rights reserved. ~ Professor Real Estate® Suzanne Hollander

Comments are closed